For the relatively petty and technical-in-nature offense, the MACC Investigating Officer froze the personal Bank accounts and shares belonging to Brian and Dino Ng.

However, the staff and management seemed unconvinced by the charges. In protest to the seemingly obvious fix up job by the Corporate Mafia group exposed by

The Corporate Secret , the key staff running the payment gateway system at Revenue have apparently resigned enbloc.

Among them are three Senior Managers, Subsidiary Managing Director, and technical Team Leaders.

Despite having an armed guard to protect the server, the payment gateway system is deemed not secured and safe for use as payment without the technical personnel.

The new management attempted to entice the staff to stay with offer to raise pay by as much as three times but to no avail.

Without the presence of the Founders in the company, the Banks, Credit Card Companies and Bank Negara Malaysia will lose confidence on the system and likely to pullout.

Without the technical personnel to running the system, the asset will be deemed useless to the company.

Sources claimed the MACC officers and DPP privately claimed they were under instruction from MACC Chief Commissioner, Tan Sri Azam Baki to charge.

However, it does not make sense for the top boss to indulge in petty offense in the midst of the Jana Wibawa debacle. More so it is demeaning for a corruption enforcement agency to be pursuing non-corruption case such as alleged car theft.

There has to be a powerful hand calling the shots for officials to be blatantly daring to act for the interest of an allegedly underworld-linked group.

Edge reported on Tuesday:

Revenue Group co-founders charged with disposing of a company vehicle illegally

March 14, 2023 12:48 pm +08

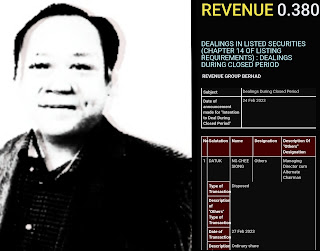

KUALA LUMPUR (March 14): Revenue Group Bhd co-founders Brian Ng Shih Chiow and Dino Ng Shih Fang were charged in the Sessions Court here on Tuesday (March 14) with fraudulently causing a bank employer to dispose of a vehicle belonging to the company without a resolution from its board of directors.

|

| Brian Ng |

The brothers had claimed trial by pleading not guilty to the charge before judge Rozina Ayob.

In the charge which was read out to them in court, the brothers had, in order to achieve common intention, allegedly misled and fraudulently caused an officer of CIMB Bank Bhd to dispose of company property, which was a Toyota Vellfire, on Oct 3, 2018.

The charge further stated that the brothers had allegedly registered the car under Dino’s name without the resolution of the board.;

The charge was framed under Section 403 of the Penal Code and is punishable under the same Act.

|

| Dino Ng |

If found guilty, the duo could face imprisonment of between six months and five years, with whipping, and are also liable to a fine.

Deputy public prosecutor Raya Low Chin How prosecuted, while the duo were represented by former Malaysian Anti-Corruption Commission (MACC) chief commissioners Tan Sri Dzulkifli Ahmad and Amer Hamzah Arshad.

The DPP asked for a bail amount of RM20,000 per accused in one surety and for their passports to be surrendered by the court.

However, Hamzah objected to the amount and asked that they be released on a personal bond.

“This is because this isn’t an offence; what is actually happening is an ongoing corporate dispute between members of the board which are split in two separate camps,” he said.

He also alluded to this group called the “corporate mafia” which is allegedly planning a hostile takeover of the company, which is the reason the brothers were charged.

“Even the media carried out news report known as ‘corporate mafia’ to do a hostile takeover; now they’re (the brothers are) under attack,” Hamzah said.

Hamzah alleged that the “corporate mafia” had made the report against the brothers at the MACC.

However, the judge said that these are mere allegations, as there were no affidavits or police reports about it.

The court then set a bail amount of RM10,000 each in one surety.

She then set a case mention on April 14.

The fact that the bail amount is set at a mere RM10,000 and passport not withdrawn for a prisonable offense indicate the judge is not convince on the gravity of the case. A source claim the freezing of the Bank account and shares have yet to receive endorsement by the court.

In addition, the conduct of the investigation is marred with inappropriate practices that will likely be responded by police reports and civil lawsuits against various parties.

In a lucky draw, the Revenue Group won a lucky draw conducted by CIMB. In view of the tax implication on the company, the two Ng brothers and then Managing Director Eddie Ng agreed and requested on CIMB to transfer the ownership to Dino Ng. The car had always been used for company purpose.

Victor Chin is known in the underworld for his car business thus the familiarity with car registeration process to pick up on such misdeamenour offenses is only expected. He may have conveniently picked on this petty issue as facade to justifiy the permanent remove of the Ng brothers.

The Corporate Mafia expect the Ng brothers to fight back to buy control of Revenue. However, they went the other way to sell and they are stuck with diminishing value in the view of the latest quarterly losses and the bearish market.

It explains for the poorly concocted and executed hostile takeover plan aided by some invisible hands dictating MACC.

.jpeg)