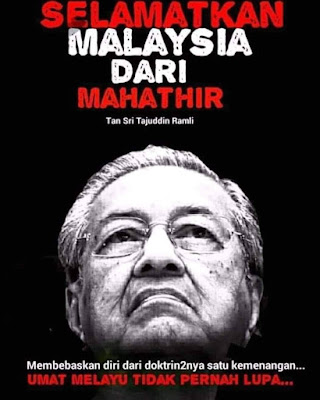

This poster sprang up on the social media prior to GE14 following an anonymous video recording by a snooper. Subsequently a formal interview was conducted with Tan Sri Tajudin Ramli, the former Chairman of MAS and founder of Celcom.

Although Mahathir went on to win Langkawi and subsequently became Prime Minister again, the Malays and Malaysians yet again realised too late the disaster he is capable of doing.

Now he is at it again and the gullible Malay will likely mudah lupa. Nevertheless, lets put the political hantu raya and his self-serving motivation on hold first.

The recent Pandora Paper investigation on Tun Daim in which it is heard Halim Saad, Nor Mohamed Yakcop, Mokhzani Mahathir, Mukhriz Mahathir, most likely Mirzan Mahathir, and others were called in by MACC.

It is timely that Newswav portal made a call on MACC to investigate Tajudin.

OPINION: MACC, please also investigate the sale of MAS to Tajudin Ramli

By FLK

On 19 May 2023, the media, both mainstream and news blogs, went to town with the report that a former senior minister and a prominent businessman, who is also a Tan Sri, are under investigation for the alleged misappropriation of over RM2.3 billion of national funds in the wake of the revelation of confidential documents through the Pandora Papers previously.

MACC should continue beyond those named in the Pandora Papers and investigate the claims by Tan Sri Tajudin Ramli, set out in a 7-minute video accessible on YouTube channel, that he was forced to buy Malaysian Airline System Bhd (MAS) shares at higher than market value by PM4 and a former Senior Minister, reportedly told him that he was not allowed to say "no" to the prime Minister with regards with the purchase of the shares.

This interview came about following a snoop video recording of a coffeehouse conversation of someone resembling Tajudin.

If Tajudin himself can reveal this openly, it shows that there were some suspicious elements involved in the deal.

Tajuddin claimed he was instructed to buy MAS at RM8 per share when the share price of MAS was trading at approximately RM3 in 1994.

In 2000, the government bought back MAS shares at RM8 a claim, a reported 117 per cent above the market price from Tajuddin. 6 years later, at a press conference after launching a book, PM4 denied it was he who instructed Tajuddin Ramli to buy MAS shares as, at that time, the government did not need the monies, albeit a wave of privatisation of national assets being carried out, at that time.

The decision to sell MAS shares to Tajuddin came out of the blue.

No tenders and competing bids. No feasibility and evaluation to evaluate the viability of the offer. Not even a slight rumour. The sale was consummated within 3 m8onths when a deal of such size then would have taken at least 6 months back in 1994 to put together, finalise and complete the documentation.

On paper, the government made a considerable profit from the sale as the share price of MAS was trading at around RM3 while Tajuddin allegedly paid RM8 per share for the takeover. When asked by the reporters what was the collateral for the loan of RM1.792 billion to buy MAS, Tajuddin proudly told the media that he was the collateral.

In June 2006, Tajudin made a counter-claim for a total of RM13.36 billion in relief from the government, TM, Telekom Enterprise Sdn Bhd and TRI. He also names some 22 individuals in his counter-claim.

The court documents revealed that the government gave him a waiver from the single-customer limit usually imposed by BNM on borrowers. The loan for RM1.792 billion was the biggest single loan given by several banks in Malaysia at that time, let alone a loan given to individuals.

In addition, there was a waiver on the stamp duties for loan agreements and transfer of shares.

However, in August 2011, the government, through the then Minister in the Prime Minister's Office, apparently directed all government-linked companies (GLC), including MAS and Danaharta, to cease all suits worth at least RM2 billion against Tajudin.

CLOB International was an over-the-counter market that was extremely popular among Singaporeans for trading, primarily Malaysian shares, in the early 1990s. It was initially established after Malaysia delisted all dual-listed stocks from the Stock Exchange of Singapore (SES) following its split from the Kuala Lumpur Stock Exchange (KLSE) in January 1990.

When Malaysia imposed capital controls and prohibited all offshore transactions of the ringgit in September 1998, it also froze the trading of all Malaysian shares on CLOB. When stocks cannot be traded, they are as good as having no value. At the time of the suspension, some 172,000 Singaporean investors held CLOB shares worth an estimated RM17 billion.

On 28 Aug 1998, Clob shares were traded at a discount of only 9% on average, compared to the prices of the shares on the KLSE. Following the announcement of the Malaysian measures on 31 Aug 98 and 1 Sep 98, the discount on Clob prices widened to 49% on 3 Sep 98. Club was suspended from trading on 4 Sep 98 and subsequently reopened for 5 trading days from 9 to 15 Sep 98. At the end of the trading period, the discount on Clob shares averaged 42%.

Effective Capital, a company owned by a Singaporean businessman who was known to be a close associate of a former Senior Minister, again probably the same former Senior Minister in the earlier investigation and who allegedly also told Tajuddin Ramil that he was not allowed to say no to PM4 to buy out the frozen shares at substantial discounts – apparently the deal was almost close to 70% of the then prevailing market prices, giving Effective Capital hundreds of millions in windfall profit.

For a US$4.5B CLOB position (apparently measured at 2000 market prices based on KLSE), Effective Capital offered US$1.5B to "take over the risk" of holding the extended position.

A former Bank Negara assistant governor reignited public attention on the Bank Negara forex speculation losses when in an interview with the media in January 2018 said that the cumulative losses from the 1990s were, in fact, US$10 billion, much higher than previously disclosed.

The government under PM6 followed up on the disclosure by setting up a task force to investigate.

In June 2018, the government formed a Royal Commission of Inquiry (RCI) to probe the matter. PM10, the Opposition Leader, was called and presented himself to be questioned by the RCI.

So were PM4 and a former Senior Minister.

--------

FLK is a content creator under the Newswav Creator programme, where you get to express yourself, be a citizen journalist, and at the same time monetize your content & reach millions of users on Newswav. Log in to creator.newswav.com and become a Newswav Creator now!

Memoirs touched the subject, but Mahathir's hide the truth and Tommy Thomas's was myopic and narrow on legality. Time for the real truth on MAS to come out.

Tajudin was a victim in the MAS episode. He was forced to buyout BNM's block of shares to revive their negative shareholders' fund.

At the material time, the international market believed BNM was hiding the true size of Nor Mohamed misadventure gambling on the foreign exchange market.

Malaysia could not raise any funds from the international market for its needs. Market suspect the lossrs to be more than the few billions mentioned in official statement. At the RCI, Zeti revealed it to be RM33 billion.

MAS, near the end of Tan Sri Aziz Abd Rahman helmship, suffered operating losses and was in the midst of its turnaround plan. So there was no takers and Tajuddin was forced to takeover.

When the late 90s ringgit crisis hit, another forex problem haunted Malaysia. Losses wiped the profitability Tajudin was building up in MAS. He had to sell the national airline back to government. The proceed from the sale was needed for his Celcom related debt.

Nor Mohamed Yakcop and Danaharta's Azman Yahya together with Nazir Razak not only denied him, but robbed his Celcom, Naluri, and the cash proceed in Naluri's subsidiary at the behest of Mahathir.

The cashpile disappeared and the subsidiary later turned up at one of Vincent Tan's companies via Siti Nurhaliza husband Dato K's Atlan Holdings.

It was not the first and last time the successful Bumiputera businessman and industrialist was robbed by Mahathir through his proxies. There could be recent ones too.

More information remain unknown and the truth on the inexhaustive list of Mahathir's financial scandals and mega project losses should come out.

Otherwise, he will keep blaming others for his misdeeds.

He is at it again under pretext of Proklamasi Melayu to manipulate Malay sentiment, especially the young, naive and clueless voters.

Thus the need to do so is indeed necessary. He intend to topple the Unity Government to cover-up his past greedy misdeeds.

His added bonus is that he can ride on Islam since Hadi Awang's faction in PAS endorsed his capitalistic, self serving and lofty pursuits.

This has to stop and Mahathir should not be allowed to run amuck and continue to leave a trail of destruction.

Malaysia need to move on than be stuck in past agony and prejudices from his deceitful ways. It need to urgently address, correct and rebuild the rubble he left behind for the future generation of Malaysians.

Selamatkan Malaysia dari Mahathir.

.jpg)

No comments:

Post a Comment