Looking at the myriad of economic challenges the present Madani government led by Anwar Ibrahim and economic management under Rafizi Ramli has to deal with, it is heart thumping.

The challenges comes in the form of long term structural problems either KIV-ed or swept dust under the carpet piled up into a protruding molehill in the middle of the living room. Then, there is the present challenges posed by the unconvincing post-Covid recovery, and on-going and potentially new clashes at several hotspots in the world.

With the politically sensitive Malaysian environment, and Rafizi accused on social media for undelivered campaign, its tempting to anticipare the making of a perfect storm in the horizon. Currently he is being criticised for giving wrong message to the market in his remark on the weakening ringgit.

Is there really a widespread economic turmoil in the making? Or it is just public jitters over the consumer level inflation, uncertain job security, and economy wide adjustment in tax and subsidies structure?

Jim O’Neill, a former chairman of Goldman Sachs Asset Management have been looking into the subject of inflation recently and wrote in The Edge Singapore and Edge Malaysia. He is a former UK treasury minister, and a member of the Pan-European Commission on Health and Sustainable Development.

He wrote the article, The Challenge of Inflation in Edge Singapore dated January 11, 2024 on the inflation horizon in the developed economies of the world. Since the full article is only available to subscribers, we reproduced the same article but different intro from Project Syndicate website dated December 15th 2023 below:

The Inflation Challenge in 2024

Dec 15, 2023

JIM O'NEILL

The latest consumer price data in major advanced economies offer some encouraging news about headline inflation trends; but core inflation (excluding energy and food prices) remains uncomfortably above central banks’ targets. Among the many variables for forecasters to watch in the new year, three stand out.

LONDON – As 2023 draws to a close, there are many known unknowns – especially on the geopolitical front – and presumably as many unknown unknowns lurking on the horizon. Producing any forecast for the global economy is thus more difficult than usual. For their part, investment houses seem to be expecting a further slowdown in 2024, with many flummoxed by the fact that we haven’t had a major slump already.

The inflation outlook poses an even bigger challenge. The past few years have shown that inflation can be heavily affected – at least on a headline basis – by uncertainty and unknown unknowns that make themselves known. A heated debate about the inflation outlook is ongoing, with some highly respected and very experienced businesspeople expressing doubts that central banks have got the problem under control. The latest consumer price data for the eurozone, the United States, and the United Kingdom offer some encouraging news about headline inflation trends; but core inflation (excluding volatile energy and food prices) remains uncomfortably above central banks’ target rates.

Of course, the world’s second largest economy, China, does not seem to have this problem. On the contrary, its most recent consumer-price data show that it is experiencing deflation, with its core consumer price index falling by 0.5% (on an annual basis) in November. There once was a time when many analysts suspected that China was transmitting deflationary pressures to the rest of the world, primarily through its low-cost manufacturing export and their increased market share in foreign markets. If we were still in that era, some of the current inflationary fears might be lessened. But those days are gone, it seems.

The scale of China’s domestic economic challenges – deflation included – is a massive question deserving of its own commentary. Given the issues facing its property market, judging by similar experiences in other countries, one can assume that its difficulties will be prolonged. But a less pessimistic view is that Chinese policymakers are fully aware of those issues, owing precisely to those previous cases, as well as the warnings that various commentators have been issuing for quite some time.

In addition to Chinese domestic factors, one also must consider the trends for global commodity prices, over which Chinese demand will remain a big influence. Here, the news toward the end of 2023 has been more encouraging than many would have expected, and suggests that headline inflation in many countries could fall further in the coming months. Despite the chaos in the Middle East and the war in Ukraine, crude oil prices remain soft, surprising many analysts – including some who should know that this market is nothing if not unpredictable.

Beyond these factors, three others stand out for me. First, monetary growth has weakened sharply in many economies, which is quite reassuring when combined with current commodity-price trends. While it has been a long time since anyone other than the most ardent monetarists claimed that money supply always bears directly on inflation, the past few years have shown that if monetary growth accelerates radically (as it did in late 2020 and early 2021 in the US), inflation can rise.

Second, and perhaps in line with the commodity and monetary trends, recent measures of inflation expectations in key countries have been reassuring. In particular, the latest University of Michigan survey of consumers’ five-year outlook showed a sharp drop, to 2.8%, from 3.2% the previous month, indicating, at a minimum, that no sustained increase or “un-anchoring” of long-term inflation expectations is taking place.

The final, and perhaps trickiest, question is how central banks will respond. In its latest forward guidance to markets, the US Federal Reserve Board suggested that interest rates would be cut by 75 basis points in 2024. Other central banks however, especially in Europe, are pushing back on financial markets’ bet that interest rates will be cut next year, but markets do not seem to have gotten the memo. With core inflation still above target, real (inflation-adjusted) wages growing, and strong evidence of productivity growth nowhere to be seen, central bankers will be loath to cut rates soon. But as they continue to try to influence markets with their guidance and public statements, they will have to accept that markets – in their collective wisdom – may see something that they themselves do not. If the data take a sharp favorable turn, they will probably change their tune.

Wage growth remains a crucial variable. In some countries, especially the UK, it is finally outpacing consumer-price growth. Policymakers instinctively will worry that this trend will trigger a textbook wage-price spiral. But wouldn’t it be nice if recent real wage growth turned out to be justified by a rebalancing of financial returns and the long-awaited return of positive productivity growth?

With a new year comes a new hope.

A good read from Project Syndicate: The Next Phase of Our Inflation Journey by MICHAEL SPENCE sees flaws in projections that the US Federal Reserve will continue to cut interest rates beyond 2024.

His follow-up article from Edge Malaysia reproduced below:

Is the outlook for the global economy still bullish?

By Jim O’Neill / The Edge Malaysia

This article first appeared in Forum, The Edge Malaysia Weekly on January 29, 2024 - February 4, 2024

Last month, I wrote about the central role of inflation trends in the outlook for the world economy in 2024 and beyond. Of course, there are many additional risks, which is why the forecasting community is hedging its projections with sensible caveats about various “known unknowns”. Chief among these are the ongoing conflicts in the Middle East and Ukraine, the uncertainty about China and the looming elections in Europe, the US and elsewhere.

With respect to inflation, I offered a cautiously optimistic outlook based on recent reports showing that many underlying indicators appeared to be moving in a promising direction. Since then, however, the latest monthly inflation data (for December) in the eurozone, the UK and the US have surprised on the upside. That has given pause to many policymakers, investors and analysts after weeks of markets pricing in large interest rate cuts this year.

Finally, I concluded by mentioning that it would be a pleasant surprise if wage gains in many countries persisted, despite the improving inflation outlook, without contributing to a fresh, more sustained rise in prices. Of course, most economists and central bankers would put little stock in this scenario unless there was clear evidence of a much-needed uptick in productivity across the Western world (and beyond). Without additional productivity, they would warn, real (inflation-adjusted) wage gains cannot be sustained without becoming inflationary.

Nonetheless, I find myself holding on to the same hope I had last month. After all, productivity data arrive with a lag, so it would be quite risky for central bankers to react too strongly to continued wage gains, such as by declaring that they will maintain a more restrictive monetary policy than they otherwise would have done.

Specifically, there are three good reasons to adopt a wait-and-see posture.

First, although forecasters failed to anticipate the persistent weakness in productivity over the past two decades, it is only recently that they seem to have given up signalling an expectation that it will start to recover.

Second, there are obvious reasons for thinking that productivity will eventually improve, even if most have given up hope. Just look at the big developments in artificial intelligence, the shift to alternative energies, the change in working patterns since the start of the pandemic and policymakers’ renewed focus on initiatives explicitly designed to boost productivity. True, the data have yet to show that these developments are bearing fruit, but again, the gains from new technologies often take time to work their way through the economy and into official statistics.

The third reason to hold off on monetary tightening concerns the social and human aspects of the wage and productivity issue. As we know from debates about the sources of growing anxiety and economic insecurity across many democracies, median real wages have performed poorly in recent decades. This trend has clearly played a big role in the public’s growing disillusionment with “capitalism” and “globalisation”, and in the rising support for more radical and populist political parties and movements. It follows that an increase in real wages would help to moderate political attitudes. Repressing wages simply because of a belief that they are unjustified would be dangerous.

Will the improvement in inflation be sustained?

Though the December inflation figures came in higher than expected, the preceding months had shown sharper-than-expected declines. If one examines the smoother underlying measures of trend inflation as well as surveys of inflation expectations, the outlook remains quite promising.

As for the other cyclical factors, three things stand out to me as we approach the end of January. Firstly, Chinese economic data and financial market performance remain generally disappointing despite stronger efforts by the authorities to support a robust recovery.

Secondly, in the US, most (though not all) economic indicators continue to come in stronger than expected. That is a relief, even if it isn’t alleviating the uncertainty among many commentators who worry that the recent positive trends may not be sustainable. Markets, too, have had a jittery start to the year. According to the so-called five-day rule (where a net gain for the S&P 500 in the first five trading days of January bodes well for the next 12 months), there is only a 50% chance that this will be a positive year for stocks. Yes, this is far from a scientific truth. But, as I have noted previously, a positive start has predicted a positive year more than 85% of the time, going back decades.

Lastly, despite the worrying issues in the Middle East and Ukraine, commodity-price volatility has remained remarkably subdued. Perhaps there are some odd technical supply-demand factors that account for this. But whatever the case, the relative stability is discernible across many markets. Most key commodities, as well as the recognised major commodity indices, are down compared with a year ago. That, too, is slightly reassuring. — Project Syndicate

Cooling inflation is feeding expectation of Fed cut in the upcoming months and recently lower unemployment benefit shows economy chugging along fine without inflationary pressure.

Wall Street has been encouraging.

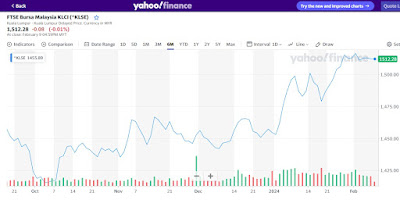

Similarly in Malaysia, headline inflation is slower and rise in wages by 8%. Together with the run on Wall Street, sentiment on Bursa Malaysia has improved though not market wide but restructed to index stocks.

The wage rise still comes with issue of distribution to the lower income. Productivity remains a concern.

The market attitude on fiscal, economic and institutional reform is positive. However, it is still a wait and see for public and businesses.

There is the fear that the initial consumer and business reaction to reform could be a setback to the economy. The expectation of a planned cut in subsidy, higher tax and regulated wage increase is driving inflationary sentiment. That has impact on political stability.

Rafizi has to contend with capital outflow from Malaysian businesses to other regional economies underlying the medium term ringgit exchange rate. This relate closely to labour shortage and the higher wages from minimum wage policy and progressive wage to be introduced.

And the inducement and support provided by neighbouring government to investors is more than what Malaysian government machinery is doing.

Export dependent Malaysia is not attracting as much FDI and the type needed for a more robust economic growth.

The billions of FDI commitment announced by Tengku Zafrul may not be as rosy as it seemed. There is the suspicion it is just numbers conjured up by hired FDI brokers.

Question is how committed is the government machinery to follow up and lubricate its stifling bureaucrasy to enable the commitment to crystalise into actual projects?

Apparently, judging from the FDI directed there, it is not as good as Indonesia and India. It is believed that there are FDI from China still awaiting the release of its initiator to get started.

Weaponising 1MDB to blame for current ringgit weakness indicate a Rafizi under tremendous pressure. The RM31 billion BNM forex loss and Mahathir slump of 2018 was more significant and impactful on ringgit than current.market gyration.

No comments:

Post a Comment